OFW REMITTANCES

Sources: BSP, IFAD, IDB, IMF,

NSO

Last updated: December 14, 2007

|

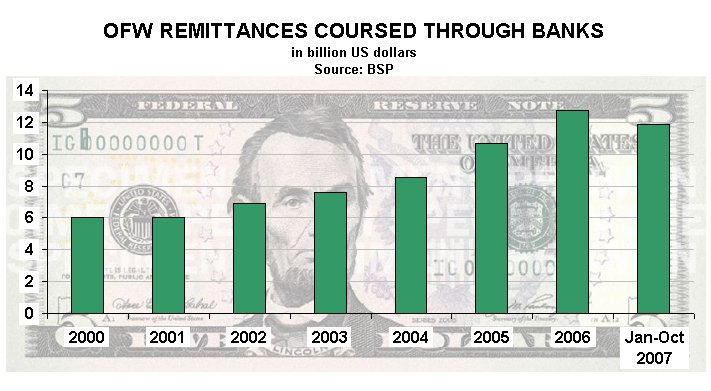

OFW remittance trends

- OFW remittances

have doubled over the past few years. From around $6

billion in 2000-2002, it rose to more than $12

billion in 2006.

- OFW remittances

from January-October 2007 are 15.2% higher compared

to the remittances for the same period in 2006.

- Since early 2006,

OFW remittances have been averaging over $1 billion

every month.

factors in the increase of OFW

remittances

- continued deployment of

Filipino workers overseas, as demand for Filipino workers in the

international labor market remains strong

- in an effort to encourage more

OFWs to send their remittances via formal (banking) channels,

financial institutions continue to expand banking services, establish more remittance centers

abroad, and tie up with foreign financial institutions for the banking needs of OFWs

|

OFW REMITTANCES

COURSED THROUGH BANKS

Source: BSP

|

YEAR |

AMOUNT (in US$) |

|

2000 |

6,050,450,000 |

|

2001 |

6,031,271,000 |

|

2002 |

6,886,156,000 |

|

2003 |

7,578,458,000 |

|

2004 |

8,550,371,000 |

|

2005 |

10,689,005,000 |

|

2006 |

12,761,308,000 |

|

Jan-Oct 2006 |

10,297,833,000 |

|

Jan-Oct 2007 |

11,865,982,000 |

|

- Migrants from developing countries sent home

more than $300 billion worth of remittances in 2006, according

to a study by the International Fund for Agricultural

Development (IFAD) and the Inter-American Development Bank (IDB).

OFW remittances in 2006 accounted for approximately 4.25% of

this $300 billion.

- The International Monetary Fund cited the

Philippines as the third largest recipient of remittances among

developing countries (behind India and Mexico) in its World

Economic Outlook Report in 2005. The study compared remittance

statistics of various developing for the period 1999-2003.

|

Majority of OFWs course their remittances in cash and

through banks.

- types of remittances sent by

OFWs:

- cash sent - 74.4%

- cash brought home - 21%

- remittances in kind - 4.6%

|

- of the total cash remittance

sent,

- sent through banks - 79.3%

- sent through door-to-door

- 13.2%

- sent through other means

(sent through the agency/ local office, friends/co-workers,

etc.) - 7.5%

|

Source: 2006 Survey on Overseas

Filipinos |

|